VAT (Value Added Tax) is an indirect tax that is levied on the consumption of any product or service regardless of the taxpayer’s income (here it doesn’t matter if you are a millionaire or poor because you will pay the same percentage). The different companies that participate in the manufacturing and distribution process of a product or service add it up, and finally it is passed on to the end consumers, who are the ones who pay for it.

There are 3 VAT rates:

- General VAT 21%: This is the percentage that applies to almost all products and services. Examples of products include tobacco, footwear, household appliances, clothing… In services we can mention hairdressing, telephony, gyms, discotheques, cinemas, theatres…

- Reduced VAT 10%: This would include foodstuffs, passenger transport, museums, art galleries, amateur sporting events…

- Super-reduced VAT 4%: Applies to basic necessities such as vegetables, fruit, bread, milk. It also applies to books and newspapers, medicines, prostheses and social housing.

The VAT increase in 2010 and 2012 meant an extra income for the Spanish State of 6500 million euros in the first case and 8000 million in the second.

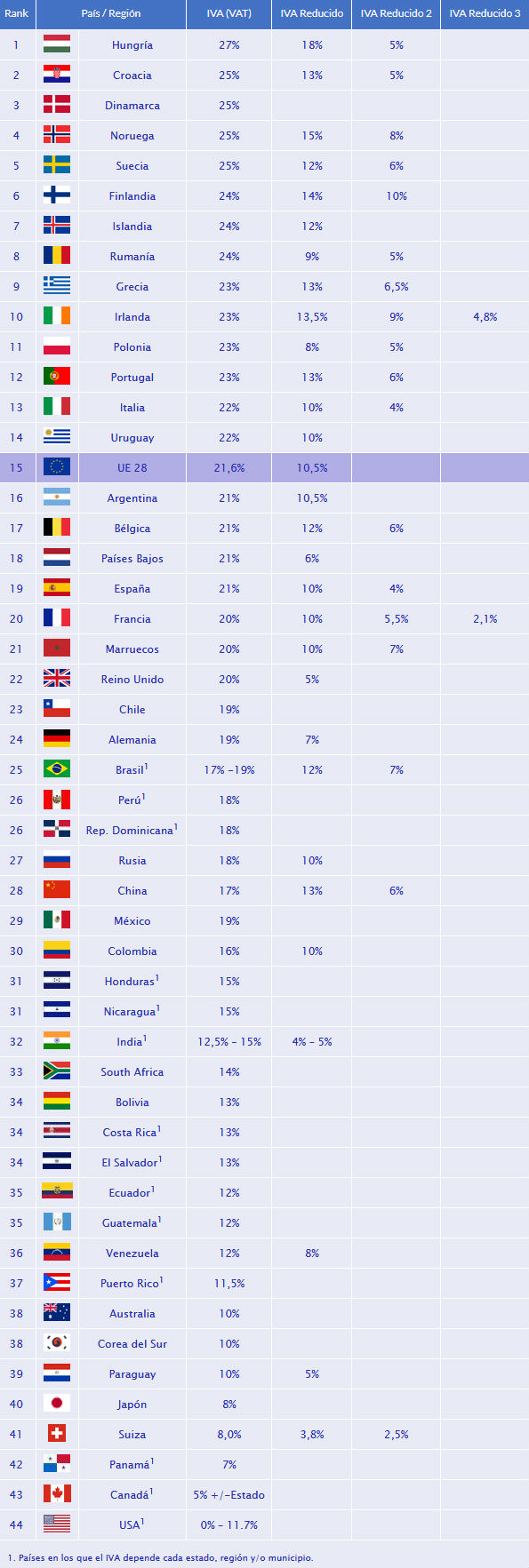

Below we show a graph where you can visualize the VAT in different countries around the world: