Our objectives are to obtain the greatest tax advantages always in compliance with tax regulations. At Ficotec, in addition to the fact that our work is a punctual and concrete advice from a specific operation, we also opt for the continuous tax planning of the company. We are your tax advisor in Irun.

The complex regulations governing tax obligations make it necessary to have the advice of reliable and experienced people who know the situation of your company. We dedicate the necessary human and material resources to ensure efficiency and speed in our actions.

Our fiscal planning is based on the study of the fiscal repercussions of your company’s operations with the aim of rationalising tax burdens, eliminating contingencies and drawing up proposals for improvement, always within the framework of the law.

The right advice can save companies and the self-employed a lot of effort

We perform tasks such as:

Declaration of IRPF withholdings (salaries, professionals, property rental, income from movable capital).

V.A.T. declaration. Direct and simplified estimation regime (VAT modules).

Instalment payments for income from economic activities. Direct and objective estimation regime (IRPF modules).

Instalment payments of Corporate Income Tax.

Declaration of intra-Community transactions.

Annual declaration of transactions with third parties.

Income and Wealth Tax.

Corporate income tax.

Tax on Economic Activities.

Settlement of the Transfer Tax and Stamp Duty (ITPYAJD).

Inheritance and Gift Tax. DME.

City Council Capital Gains (IMIVTNU).

We also carry out

Reports on all those issues that, due to their special importance, require a detailed analysis, incorporating the current regulations, the interpretative criteria of the Administration and the jurisprudence of the courts.

Preparation of the Annual Accounts (Balance Sheet, Profit and Loss Account, Annual Report, Statement of Changes in Equity, Statement of Cash Flows) and filing at the Commercial Registry.

Assistance, representation and defence before the different Tax Administrations, on the occasion of petitions, requirements and inspections. Preparation, review and presentation of writings addressed to the Tax Agency, Generalitat, City Council.

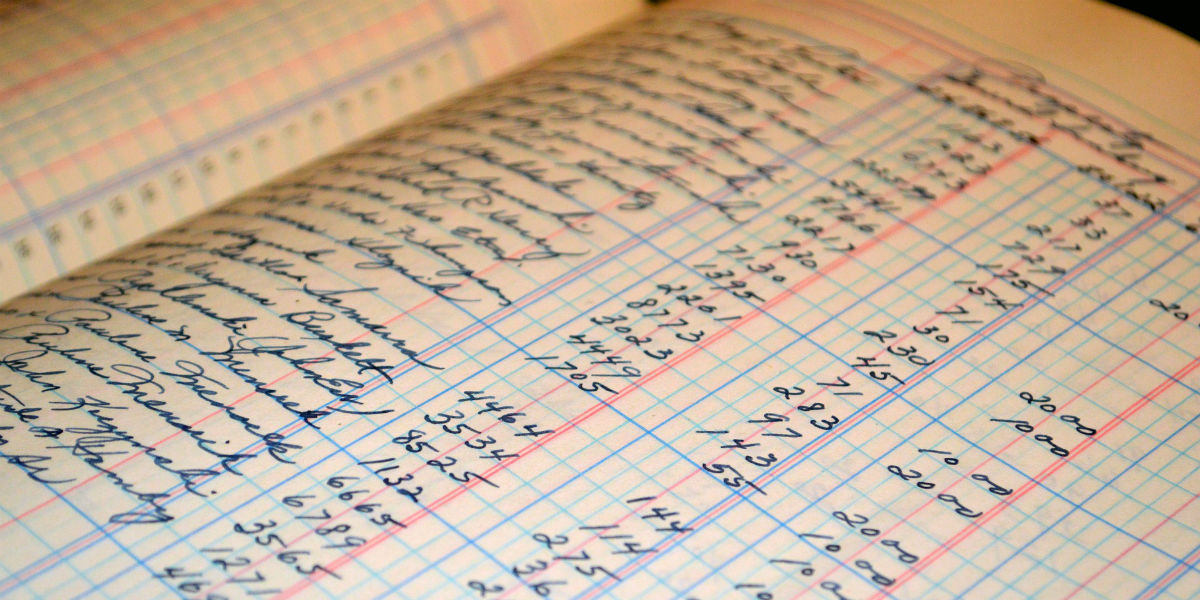

We take care of complying with the tax legislation that imposes on taxpayers who carry out business activities the obligation to keep different record books, depending on the tax regime to which they are subject and the type of activity carried out:

Record book of sales and income.

Purchase and expense record book.

Investment goods register book.

Register of the provision of funds and supplies.

Book of invoices issued.

Book of invoices received.