The Transfer Tax and Stamp Duty is an indirect tax which, under the terms established in the following articles, will be levied:

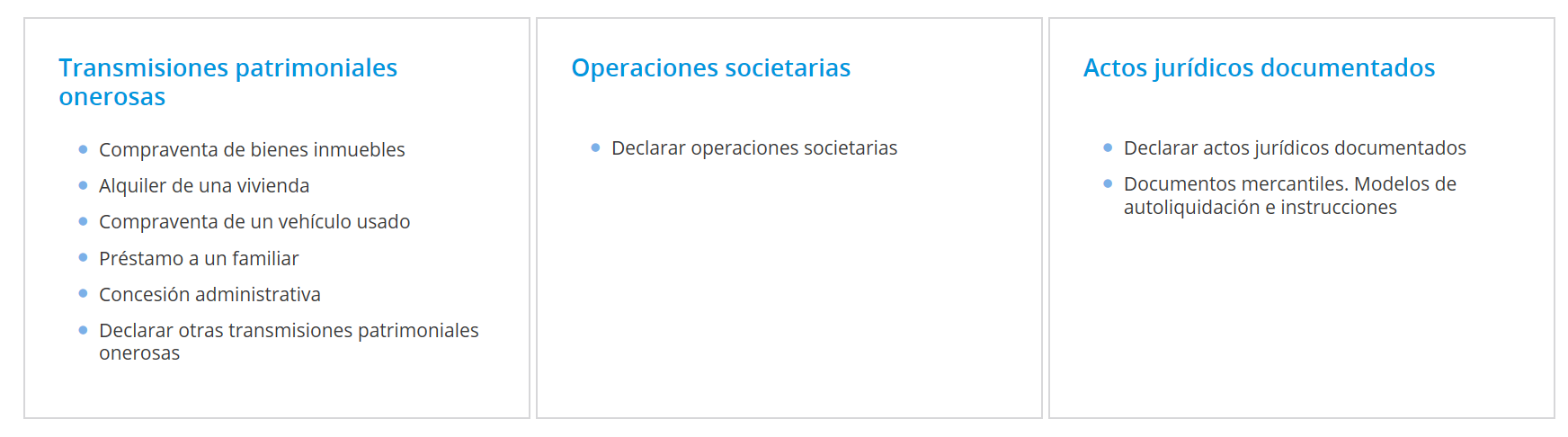

1. Transfers of property for valuable consideration.

2. Corporate transactions.

3. Documented legal acts.

Both Value Added Tax (VAT) and Transfer Tax and Stamp Duty (ITAJD) are levied on the transfer of goods and rights. VAT is applied when the transferor is a businessman or professional and the concept “Transmisiones Patrimoniales Onerosas” (TPO) of the ITP and AJD is applied when the transferor is a private individual.